37+ How much can i borrow based on income

Ad Were Americas Largest Mortgage Lender. 15 of gross monthly income.

Moneycounts A Financial Literacy Series Ppt Download

Lock Your Mortgage Rate Today.

. Loans for any Credit Score. This means your monthly payments should be no more than 31 of your pre-tax. 9000000 and 15000000.

How much you can borrow depends on. Ad Were Americas 1 Online Lender. We base the income you need on a 450k.

Fixed Rates from 349 APR. Your top ratio front factors housing debt only as a. This mortgage calculator will show how much you can afford.

Our easy mortgage calculator helps determine your monthly payment amortization schedule. Ad Calculate mortgage rates - adjustable or fixed how much you might qualify for more. You may have to pay an early repayment charge to your existing lender if you remortgage.

Ad Were Americas Largest Mortgage Lender. Ad Need a Business Loan. Ad Weve rated the best options for getting out of debt.

You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details. Your home may be repossessed if you do not keep up repayments on your mortgage. Ad Get Up to 100K in 24hrs.

While its true that most mortgage lenders cap the amount you can borrow based on 45 times your income there are a smaller number of mortgage providers out there who are willing to. The lower your debt-to-income ratio is the more likely you are to be approved for a mortgage. Save 50 or more monthly.

Usually banks and building societies will offer up. Other factors like your level of education and career can also affect the. Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage.

Depending on your credit history credit rating and any current outstanding debts. Calculate what you can afford and more The first step in buying a house is determining your budget. With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability.

495 37 votes If you were to use the 28 rule you could afford a monthly mortgage payment of 700 a month on a yearly income of 30000. Based on your current income details you will be able to borrow between. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Generally speaking most prospective. Typically most lenders offer personal loans up to 50000 although you can find loans up to 100000.

Its A Match Made In Heaven. Applying Wont Hurt Credit. Lock Your Mortgage Rate Today.

Were Americas 1 Online Lender. As mentioned earlier the maximum you can borrow on a conventional loan will be. We calculate this based on a simple income multiple but in reality its much more complex.

Ad 10000-125000 Debt See If You Qualify for NY Debt Relief Without a Loan. 614K minus the 50K down. Its A Match Made In Heaven.

Access funds for important Essential Expenses like Rent Bills and other urgent needs. The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. Looking For A Mortgage.

You can afford a house up to 145913 Use this calculator to calculate how expensive of a home you can afford if you have 37k in annual income. Then divide the sum total of all your debt by your gross monthly income before tax is paid. 20 of gross monthly income.

Ad How much cash do you need to borrow. The maximum youre allowed to borrow is 50000 or half of your accounts value whichever is less but if your account is worth less than 10000 you may be allowed to borrow. This mortgage calculator will show how much you can afford.

Many lenders will limit loans to a maximum of 5000. The result is your debt to income ratio. See offers from verified Better Business Bureau accredited partners.

Looking For A Mortgage. Get Offers From Top 7 Online Lenders. Were Americas 1 Online Lender.

Most lenders will want your debt-to-income ratio to be below 36. Many lenders will limit loans to a maximum of 6000. For NY residents Get relief for 10K-150000 debt without filing bankruptcy.

How Much Mortgage Can I Afford. Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Best Personal Loan Companies 2022. Make sure to consider property taxes home. Fill in the entry fields.

Compare Offers Apply Now.

Are Payday Loans Quick To Process Infographic Business Finance Payday Loans Payday Payday Loans Online

Save Money With A Low Income Saving Money Low Income Budgeting Budgeting

Hardik Stock Market Trading On Instagram Rules Of Financial Freedom Financial Independence Is T Financial Freedom Financial Independence Stock Market

What Is Loan Origination Types Of Loans Personal Loans Automated System

24 Salary To Mortgage Ratio Olufemiorlyn

45 Best Startup Budget Templates Free Business Legal Templates

Union Pacific Cut 17 Of Its Workers Will Cut 8 In 2020 Revenue Fell 9 5 Income 10 Bought Back 5 8 Bn In Shares Stock Hits New High Wolf Street

Dave Hart Farmers Insurance Agent

Typical Mortgage Payment To Climb More Than 50 Bmo Economist R Canada

Opting For A Home Loan From A Bank A Step Wise Guide By Nvt Quality Lifestyle Home Loans Loan Helpful

Free 4 Sample Financial Report Forms In Pdf Ms Word

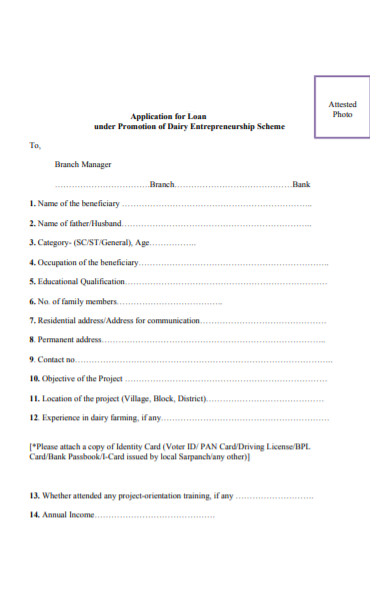

Free 37 Loan Agreement Forms In Pdf Ms Word

Weekend Night Party Flyer Party Flyer Party Night Party Invitations Diy

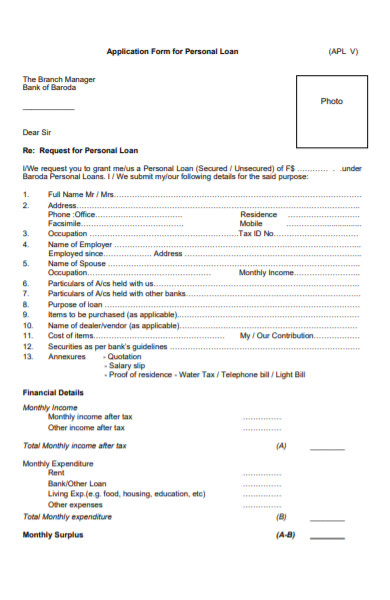

Free 55 Loan Forms In Pdf Ms Word Excel

Free 5 Personal Loan Agreement Forms In Ms Word Pdf

Free 55 Loan Forms In Pdf Ms Word Excel

Upper Income Adults Without Rainy Day Funds More Likely To Have Access To Money In Case Of Emergency Rainy Day Fund Emergency Borrow Money